Recently, shipping companies have started a new round of price increase plans, and shipping companies such as HPL, CMA, MSK, and COSCO Shipping have once again issued fee collection adjustment notices for some routes. In addition, according to a recent announcement from the Ningbo Shipping Exchange, the South American East Route Freight Index increased by 15.3% month on month from October 28th to November 3rd.

HPL and CMA increase shipping costs

HPL raised FAK rates from the Far East to Nordic and Mediterranean regions. Recently, HPL announced that starting from December 1st, FAK rates for round-trip between the Far East, Nordic Europe, and the Mediterranean will be increased, and the price increase applies to goods transported in 20 foot and 40 foot containers.

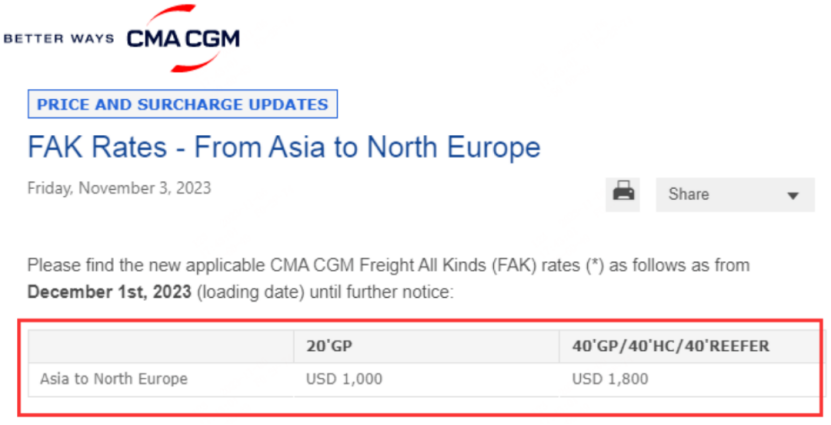

In addition, CMA has also updated the rates for FAK from Asia to Northern Europe.

Effective from December 1, 2023 (loading date) until further notice. $1000 per 20 foot dry container and $1800 per 40 foot dry/high/refrigerated container. The details are as follows:

At the same time, CMA has also adjusted FAK rates from Asia to the Mediterranean and North Africa. Effective from December 1, 2023 (loading date) until further notice.

MSK and COSCO Shipping Levy Surcharges

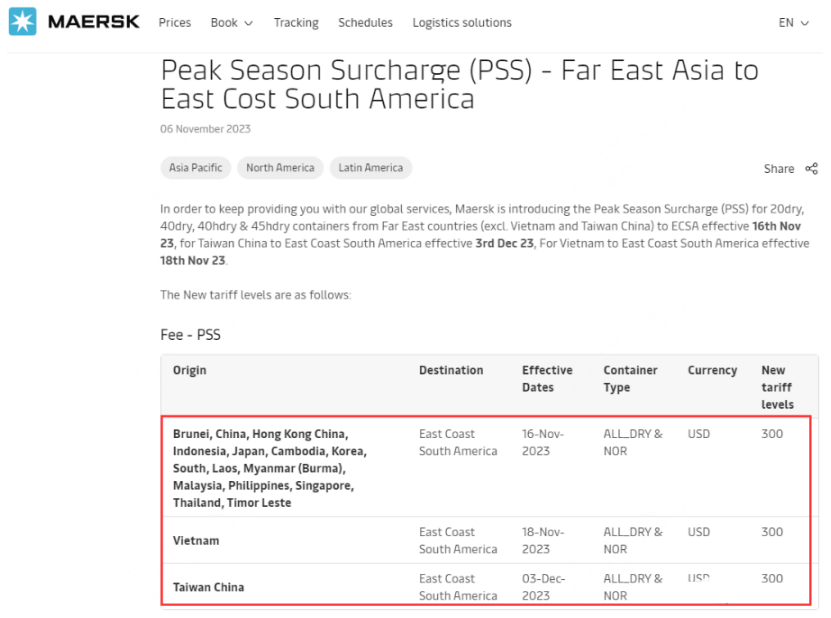

Recently, another shipping giant, MSK, announced the imposition of a peak season surcharge PSS from the Far East to the South American East. The peak season surcharge will be levied on all dry cargo containers from Greater China and Northeast Asia (excluding Taiwan, China) to central/southern West Africa from November 6, 2023. The details are as follows:

Taiwan, China will take effect from December 3, 2023, and Vietnam will take effect from November 18, 2023.

In addition, MSK has announced the imposition of a peak season surcharge PSS from the Far East to West Africa. At the same time, COSCO Shipping recently issued a notice stating that, given that the EU carbon emissions trading system will be officially implemented for the shipping industry from January 1, 2024, it will significantly increase its operating costs. Therefore, the company plans to introduce ETS surcharges on routes involving the European Union starting from January 1, 2024. The company further explained that it will fully consider factors such as route and ship type characteristics, cargo types, and services provided on the basis of normal freight rates, and make a reasonable estimation of additional fees. At the same time, COSCO Shipping has also released additional fee guidelines, including: $3.5 per ton for pulp; In principle, semi submersible ships are determined based on actual carbon emissions. The container costs $120/TEU and $240/FEU; The cost for major items, general cargo, and other goods is $4.0 per ton of freight.

In addition, COSCO Shipping emphasizes its commitment to promoting green shipping, striving to reduce carbon emission intensity, and hopes to cooperate with partners in the use of new energy in ships. The South American East Route Freight Index rose 15.3% month on month

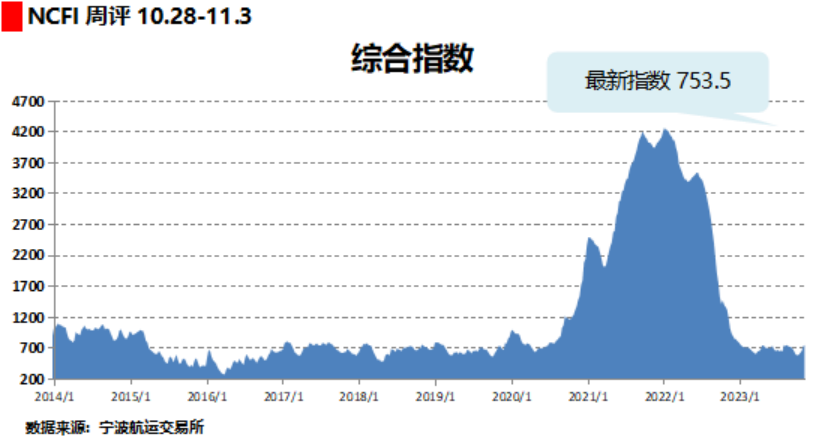

Recently, according to the Ningbo Shipping Exchange, from October 28th to November 3rd, the Ningbo Export Container Freight Index of the Maritime Silk Road Index released by the Ningbo Shipping Exchange closed at 753.5 points, an increase of 3.5% from last week.

Among them, 10 out of 21 routes had an increase in their freight index, while 11 routes had a decrease in their freight index. Among the major ports along the "Maritime Silk Road", the freight index of 8 ports increased while the freight index of 8 ports decreased.

Euroterrestrial routes. The liner companies strictly control the available capacity, and the freight rates on European routes continue to rise. Due to relatively insufficient transportation demand, freight rates on the Mediterranean route have declined, with the western route experiencing a significant decline.

The freight index of European routes was 516.6 points, an increase of 4.7% compared to last week; The freight index of the eastern route was 642.0 points, a decrease of 0.9% compared to last week; The freight index of the Dixi route was 698.6 points, a decrease of 8.4% compared to last week.

North American routes. The overall cabin space on the route is tight this week, and the market freight rates continue to rise. The freight index of the US East route was 849.7 points, an increase of 8.3% compared to last week; The freight index for the US West route was 1222.6 points, an increase of 10.7% compared to last week.

Middle East route. The flight space continues to be tight, and liner companies continue to push up freight rates, leading to an increase in spot market booking prices. The Middle East route index was 987.2 points, up 8.7% from last week.

The South US East route market has experienced significant fluctuations this week. Due to the continuous increase in demand at the destination, spot market booking prices have risen by over 10% for four consecutive weeks. The freight index for the South American East route was 1611.9 points, an increase of 15.3% compared to last week.